Stay Ahead of the Curve

Latest AI news, expert analysis, bold opinions, and key trends — delivered to your inbox.

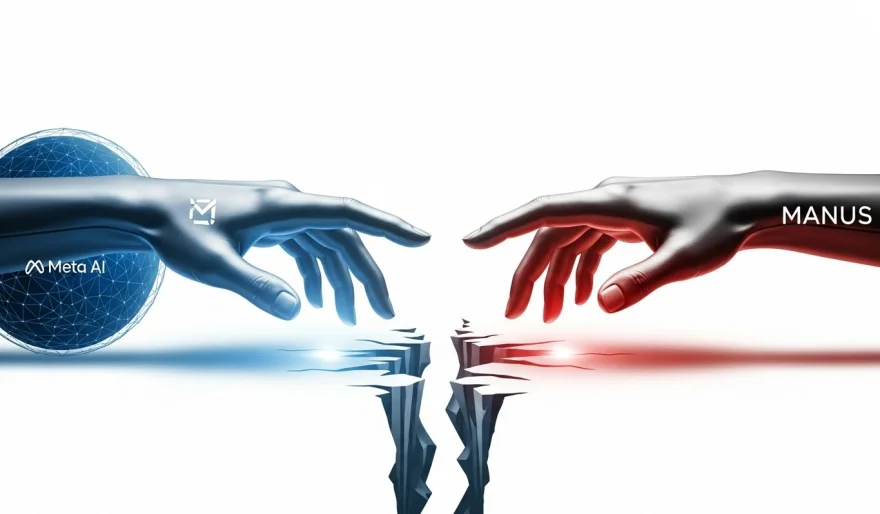

Meta’s Manus Deal Exposes a New AI Cold War

7 min read Meta’s $2B acquisition of AI startup Manus is getting opposite reactions globally. U.S. regulators see it as proof American AI remains more attractive, while China is reviewing whether Manus illegally exported AI tech when it moved from Beijing to Singapore. The deal could set a precedent for how Chinese AI startups exit — or get blocked. January 07, 2026 11:44

Meta’s $2 billion acquisition of AI assistant startup Manus was always going to attract regulatory attention. What’s surprising is where the resistance is coming from. In the U.S., regulators now appear largely comfortable with the deal. In China, however, the mood is far more cautious — and potentially confrontational.

Earlier this year, the political heat was firmly on the American side. When Benchmark led a funding round in Manus, U.S. Senator John Cornyn publicly criticized the investment, and the Treasury Department launched inquiries under new rules designed to restrict U.S. capital flowing into Chinese AI firms. The pressure was intense enough to push Manus to relocate its core operations from Beijing to Singapore — a move a Chinese academic later described as a “step-by-step disentanglement from China.”

Now the tables have turned.

According to the Financial Times, Chinese regulators are reviewing whether Meta’s acquisition could violate technology export controls. The focus is on whether Manus required an export license when it moved its core AI team and technical know-how out of China — a practice so common it’s earned a nickname: “Singapore washing.” While a recent Wall Street Journal report suggested China had limited leverage given Manus’ presence in Singapore, that assessment may have been optimistic.

Beijing has used similar export-control tools before, including during efforts to block a forced TikTok sale under the Trump administration. One Chinese academic even warned that Manus’ founders could face criminal liability if restricted technologies were exported without authorization.

At the strategic level, China’s concern is straightforward: a clean Meta-Manus deal could encourage more Chinese AI startups to physically relocate abroad, sell to Western tech giants, and escape domestic oversight. As Winston Ma, an NYU law professor and partner at Dragon Capital, told the Journal, a smooth closing would “create a new path for young AI startups in China.”

In Washington, the same deal is being interpreted as a quiet win. Some analysts argue it validates U.S. investment restrictions by showing that Chinese AI talent is choosing to exit rather than remain constrained. One expert told the FT the acquisition proves “the U.S. AI ecosystem is currently more attractive.”

Why this matters

This deal isn’t really about Manus — it’s about control over AI talent, models, and know-how.

Governments are realizing that traditional borders don’t work well for AI. Engineers can move, models can be retrained, and companies can reincorporate in friendlier jurisdictions almost overnight. The Manus case highlights a growing reality: AI regulation is becoming less about where a company is headquartered and more about where its people, data, and intellectual property originated.

If China successfully asserts export-control authority here, it could slow or block future AI exits. If it doesn’t, it risks accelerating a brain drain just as AI becomes central to economic and military power.

What this means for AI companies

-

Relocation is no longer a clean escape hatch. Moving to Singapore or another neutral hub may still help — but regulators are increasingly looking backward at where core technology was developed.

-

Cross-border M&A just got riskier. Acquisitions involving AI startups with Chinese roots may face scrutiny from both sides, increasing deal timelines and uncertainty.

-

Talent strategy is now geopolitics. Hiring, team location, and IP ownership are becoming regulatory decisions, not just operational ones.

In short: AI startups can’t afford to treat geopolitics as an afterthought anymore.

What this means for AI users

For everyday users, this may feel distant — but it isn’t.

-

Fewer deals could mean slower product rollouts. Regulatory delays can stall integrations and new features.

-

More fragmented AI ecosystems. Users may increasingly see different AI capabilities depending on region, platform, or regulatory alignment.

-

Higher compliance costs = fewer “free” tools. As legal and regulatory overhead rises, AI services may become more expensive or more restricted.

The bottom line: The Manus acquisition is a preview of a future where AI innovation doesn’t just depend on better models — it depends on which governments are willing to let those models move, merge, and scale.

AI Agents

AI Agents