Stay Ahead of the Curve

Latest AI news, expert analysis, bold opinions, and key trends — delivered to your inbox.

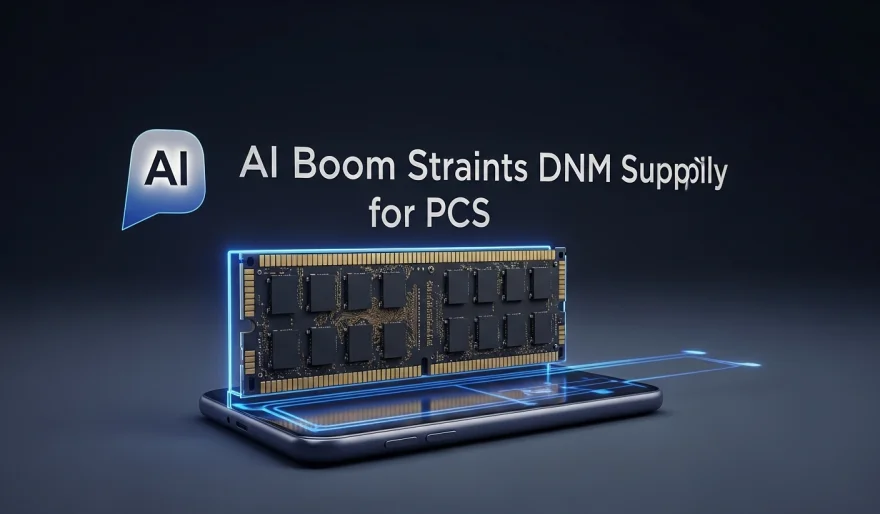

Samsung and SK Hynix Warn AI Chip Demand Is Squeezing DRAM for PCs and Phones

3 min read Samsung and SK Hynix, which control two-thirds of the DRAM market, warn that AI infrastructure demand is limiting chip supplies for PCs and smartphones. Consumer electronics makers like Apple could face higher costs and supply delays as memory is prioritized for AI data centers. January 29, 2026 11:25

Two of the world’s largest chipmakers, Samsung Electronics and SK Hynix, have sounded the alarm: DRAM chips for PCs and smartphones are about to get tighter, as demand for AI infrastructure chips takes priority.

Together, Samsung and SK Hynix control roughly two-thirds of the global DRAM market, supplying major customers like Apple. Their warnings highlight that the AI boom is reshaping the chip supply chain, and it’s consumer electronics that may feel the squeeze first.

What’s Happening

-

AI data centers require high-margin memory chips, often at the expense of DRAM for PCs and smartphones.

-

As Samsung and SK Hynix shift production toward these lucrative AI chips, consumer electronics companies could face higher costs and shortages.

-

This dynamic is putting margin pressure on PC and phone makers and could disrupt product launches or availability.

Why It Matters

-

For the industry: The AI boom is not just a software story — it’s affecting the physical supply of chips.

-

For consumers: PC and smartphone prices could rise, or new product releases could be delayed.

-

For investors: Memory chipmakers may see profits surge on AI chips, but consumer tech margins may tighten.

The Takeaway

The AI revolution isn’t just reshaping software — it’s reordering the global semiconductor market. Samsung and SK Hynix’s warnings show that even everyday devices could feel the ripple effects of skyrocketing AI demand.

Hot take: In 2026, your next laptop or phone might cost more — not because of new features, but because AI got there first.

AI Agents

AI Agents